If you’re thinking of changing your car, how much you pay for insurance may be important to you. To help with this, all cars sit in insurance groups. Knowing about a car’s grouping will enable you to do an accurate, back-to-back comparison with other models you might be interested in.

Read on to find out what an insurance group is and how to find out what group a car is in.

What is an insurance group?

Putting every car into an insurance group is an easy way for insurers to work out how much we pay for cover. There are 50 insurance groups. Group 1 is the lowest risk and therefore features the cheapest cars to insure; Group 50 is the highest risk and thus most expensive.

Why are insurance groups important?

The insurance group your car falls in will determine how much you pay every year or month for cover. And that makes it worth understanding which group your specific car is in.

As an example, it’s not as simple as saying that all Ford Fiestas are in Group 5 (although some are). A Fiesta 1.1 Style model sits in Group 2 so theoretically among the cheapest cars on the road to insure. But plump for a racy Fiesta ST-3 1.5 turbo and you’ll find it’s in Group 28 – significantly more expensive.

What insurance group is your car in?

The easiest and most accurate way to find out a car’s insurance is to go to the Thatcham Research website. Enter the vehicle details in the boxes and it will come up with information including its insurance group and Euro NCAP crash test rating.

Who sets insurance groups?

Every month the group rating panel meets comprising the Association of British Insurers (ABI) and members of the insurance industry represented by the Lloyds Market Association. The panel sits to decide the insurance groups for new cars. It uses information acquired by Thatcham Research, a not-for-profit, insurer-funded organisation in Berkshire.

How are insurance groups set?

Multiple factors go into deciding a car’s insurance group. The car’s price when new is considered. Equally, so is its performance. That means assessors take into account 0-60mph acceleration time and top speed. According to Thatcham Research: “Insurers know very well, from their claims statistics, that high performance cars often result in more frequent insurance claims.”

Whether the car features Autonomous Emergency Braking counts too. Cars with these systems are less likely to have low-speed front-to-rear collisions.

Assessors also consider the vehicle’s security features. These include higher security door locks, alarm/immobilisation systems, glass etching, coded audio equipment, locking devices for alloy wheels and visible VIN or Vehicle Identification Numbers.

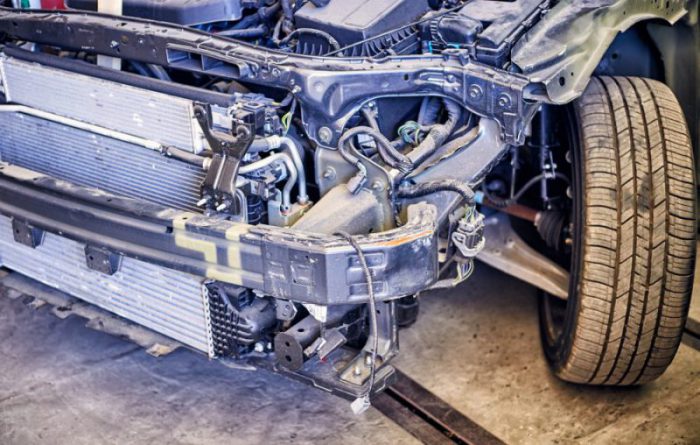

Repair costs are important too

More than half the money that’s paid out by insurers after crashes goes on repairing cars so the cost of parts and repair times are a major factor. The experts at Thatcham determine these using a 15km/h crash impact. Following the test, they then work out how long it will take and cost to return the car to its pre-crash state.

A list of 23 common parts enables insurers to compare different car manufacturers. The lower the parts cost, the lower the insurance group.

Thatcham Research also says the alignment and compatibility of front and rear bumpers can result in lower repair costs following front-to-rear crashes. Cars with bumpers deemed insurer-compatible will receive lower insurance ratings.

Recommended ratings

Frequently you will see a car’s insurance group followed by a letter. This letter is a security advisory. It uses the letters A, D, E, U and G to indicate the level of security fitted as standard to the vehicle.

A: Vehicle meets the security requirement for the group

D: Doesn’t meet the security requirements so it features in a higher group. For example, a car that would have fallen in Group 9 would be described as 10D if Thatcham didn’t think its security was up to scratch.

E: Exceeds security for its class. So if a car would have been in Group 16 it might be listed as Group 15E.

U: Unacceptable level of security in a car. It won’t be uninsurable, but insurers may insist on security being upgraded.

G: Import. Insurance groups do still cover vehicles listed as imports. These are split into ‘parallel’ and ‘grey’ import categories.

Market value loose money if they have to replace the car after an accident We are told we get the market value .Is this related to the second hand value not what it would cost

to replace the car from a dealer